A Relief for Canadian Shoppers

Starting soon, Canadians will see a much-needed break at the checkout. Prime Minister Justin Trudeau announced Canada’s 2 Month Tax Holiday on Thursday that the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) will be paused for two months on a range of essential items. This includes children’s clothing, diapers, restaurant meals, pre-prepared foods, and even popular stocking stuffers.

A Nationwide Initiative

Canada’s 2 Month Tax Holiday will apply across the country and is designed to address lingering affordability concerns. The federal government hopes this measure will provide relief to families and individuals feeling the pinch of rising living costs.

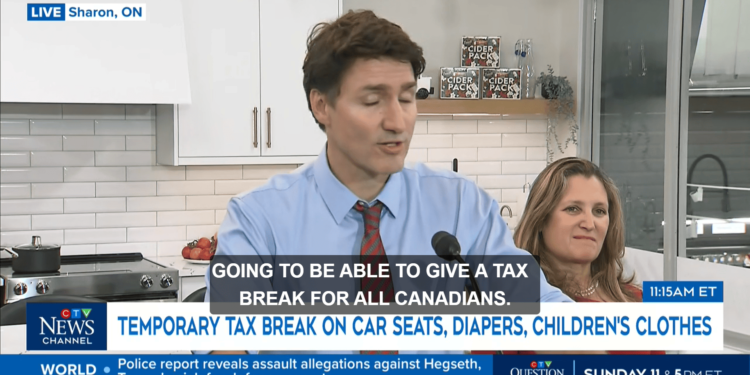

Trudeau’s Message to Canadians

“Canadians have been through a lot. They work hard. We see that,” Trudeau stated during the announcement. “Everyone had to tighten their belts a little bit. Now we’re going to be able to give a tax break for all Canadians.

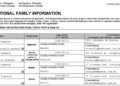

Relief for Canadian Shoppers: A Closer Look at Tax-Free Items

Between December 14 and February 15, Canadians will benefit from the Canada’s 2 Month Tax Holiday on a wide range of consumer goods. Here’s a breakdown of the items included in this temporary GST/HST pause:

- Prepared Foods: Salads, sandwiches, pre-made platters, and baked goods like cakes, pies, doughnuts, and brownies.

- Restaurant Meals: Dine-in, takeout, or delivery options.

- Snacks & Treats: Chips, cheese puffs, popcorn, candies, chocolate, gum, ice cream, frozen desserts, and pudding.

- Drinks: Beer, wine, ciders, coolers, and select non-alcoholic beverages.

- Children’s Essentials: Clothing, footwear, car seats, and diapers.

- Toys & Games: Dollhouses, toy cars, Lego, action figures, video games, consoles, controllers, jigsaw puzzles, board games, and card games.

- Books & Newspapers: Print newspapers and certain book categories.

- Holiday Décor: Natural and artificial Christmas trees.

Additionally, Prime Minister Justin Trudeau, alongside Deputy Prime Minister and Finance Minister Chrystia Freeland, announced a new “Working Canadians Rebate” during a visit to Sharon, Ontario.

This initiative offers further financial relief and support for working families, adding to the federal government’s efforts to address affordability challenges.

Who Qualifies and How the Temporary Tax Break Will Work

Starting December 14, businesses across Canada are expected to remove the GST (Goods and Services Tax) and, in some provinces, the HST (Harmonized Sales Tax) on eligible items at checkout. The HST applies in specific regions, including Ontario, Newfoundland and Labrador, Nova Scotia, New Brunswick, and Prince Edward Island.

Who Benefits from the Tax Break?

- Any Canadian purchasing qualifying goods during the two months will automatically see the tax savings applied at checkout.

- The federal government estimates this relief will cost $1.6 billion and save a family spending $2,000 on qualifying items approximately $100 between December 14 and February 15.

The Working Canadians Rebate: More Help Coming

In addition to the tax holiday, the government announced a $250 “Working Canadians Rebate” set to benefit 18.7 million Canadians. Here’s how it will work:

- Payments are expected to roll out in April 2025 as part of the federal affordability measures.

- The Canada Revenue Agency (CRA) will handle the distribution, sending payments directly to eligible recipients through direct deposit or cheque.

This dual approach aims to provide immediate savings and longer-term financial support to ease affordability pressures across the country.